Table of Contents

ToggleIntroduction

Surgery to remove a cataract is a popular and effective option for many people. Patients frequently wonder if their health insurance will pay for cataract surgery. This comprehensive guide will address frequently asked questions and delve into the intricacies is cataract surgery covered by medical insurance.

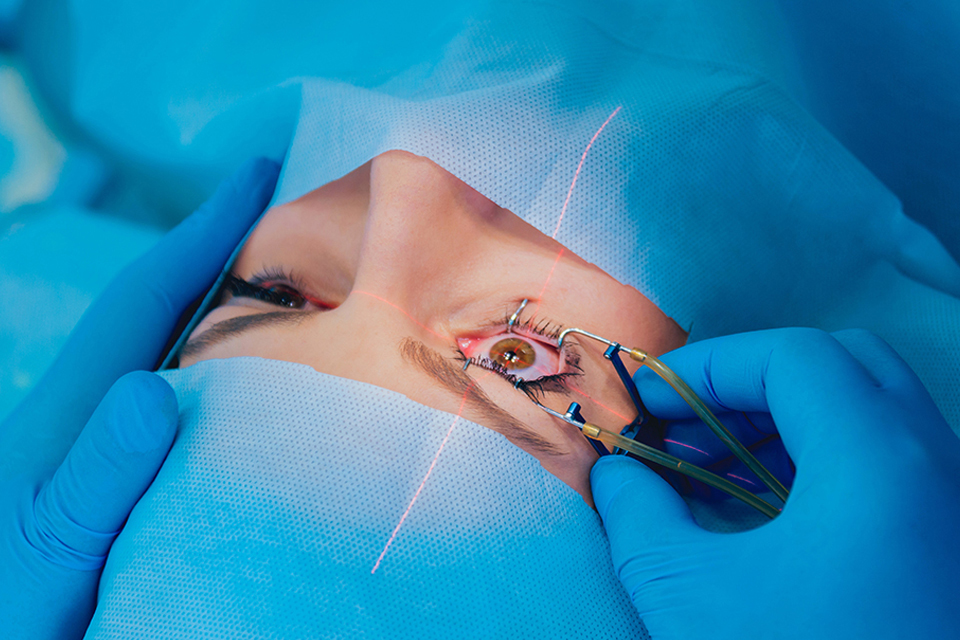

Understanding Cataracts and the Need for Surgery

Before discussing insurance, it is crucial to thoroughly comprehend cataracts and the possibility of surgery. Cloudiness of the eye’s natural lens is the medical term for developing cataracts. Blurred vision and difficulties seeing in low light are only two of the many visual impairments that can result from this. After cataract surgery, which involves extracting the clouded lens and substituting it with an artificial one, patients can see again.

Does Medical Insurance cover Cataract Surgery?

This guide’s principal objective is to answer the age-old topic of whether or not cataract surgery is covered by health insurance. Sure, in most cases, that’s the case. Most health insurance policies will pay for cataract surgery because it is a medically essential operation. Nevertheless, the level of protection could differ based on the insurer and the conditions of the policy.

Understanding Blue Cross Blue Shield Cataract Surgery Coverage

They know the ins and outs of your Blue Cross Blue Shield (BCBS) insurance policy. Given the company’s stellar reputation, many BCBS policyholders are curious about whether or not their insurance will cover the cost of cataract surgery. Since cataract surgery is considered medically necessary, BCBS typically pays for it. But you could have to pay for some of it through deductibles, copayments, etc.

How Does Insurance Not Pay for Cataract Surgery?

Patients may still be required to pay out of pocket for cataract surgery, even if insurance often covers it. Patients should be aware of what parts of cataract surgery are not covered by their insurance in order to make well-informed decisions. Premium intraocular lenses (IOLs) and more sophisticated eye exams can be out of your price range. Contacting one’s doctor is the best way for patients to learn what their insurance will and will not cover.

Navigating the Cost of Cataract Surgery Without Insurance

The high expense of cataract surgery is a significant worry for those who do not have health insurance. Knowing the cost of cataract surgery without insurance is essential for anyone looking at self-pay options. Several variables, including location, surgery facility, and intraocular lens type, might affect the final price. Uninsured patients should expect to pay between $3,000 and $6,000 for each eye for cataract treatment. Patients should get comprehensive cost estimates from their healthcare provider of choice.

Factors Affecting Cataract Surgery Costs

Whether or not insurance pays for cataract surgery depends on several factors. Some of these criteria are:

Choice of Intraocular Lens (IOL):

Premium IOLs, which can correct astigmatism or provide multifocal vision, may result in additional costs not covered by insurance.

Surgical Facility:

The type of facility where the surgery can impact costs. Ambulatory surgery centers may have different pricing structures compared to hospital-based facilities.

Geographical Location:

The final price tag for cataract surgery can change depending on regional healthcare costs and standard of living.

Surgeon’s Fees:

Surgeons’ prices are affected by their reputation and level of experience, affecting the total cost of the surgery.

Insurance Preauthorization and the Importance of Checking Coverage

Before undergoing cataract surgery, patients must check with their insurance provider and obtain preauthorization. This process involves confirming coverage details and ensuring the planned procedure is eligible for insurance benefits. Please obtain preauthorization to avoid unexpected out-of-pocket expenses.

Frequently Asked Questions (FAQs)

Q1: Do all insurance providers cover cataract surgery?

A1: In most cases, insurance will pay for cataract surgery because it is considered a medically necessary procedure, though this can differ from one provider to another. People should contact their insurance provider if they are curious about the specifics of their policy.

Q2: Does Blue Cross Blue Shield cover cataract surgery?

A2: In most cases, Blue Cross Blue Shield covers cataract surgery as it is considered medically necessary. However, copayments, deductibles, and other out-of-pocket expenses may apply. Patients should contact their BCBS representative for detailed coverage information.

Q3: What part of cataract surgery is not covered by insurance?

A3: Although most health insurance policies will cover the operation itself, they may not cover all associated expenses. Modern intraocular lenses (IOLs) and cutting-edge testing options may be among these. Patients can contact their insurance provider to find out specifics regarding their coverage.

Q4: How much is cataract surgery without insurance?

A4: Cataract surgery out-of-pocket cost can vary depending on several factors, including location, intraocular lens choice, and surgical facility. You should expect to pay around $3,000 to $6,000 for each eye. If patients want precise cost estimates, they should talk to their doctor.

Conclusion:

Understanding Insurance Coverage Variability:

While cataract surgery is generally covered by medical insurance, the level of coverage can vary significantly among different insurance providers. Patients are advised to thoroughly review their insurance policies to grasp the specific details of coverage, ensuring they are well informed about potential out-of-pocket costs.

Blue Cross Blue Shield: A Key Player in Coverage:

Blue Cross Blue Shield is a prominent insurance provider that typically covers cataract surgery. However, patients with BCBS policies should be aware of nuances in coverage, such as copayments and deductibles, which might contribute to the overall financial responsibility associated with the procedure.

Unveiling the Uncovered: What Insurance May Not Fully Cover:

Patients must recognize that while cataract surgery is usually covered, certain aspects may not be fully included in insurance plans. Premium intraocular lenses (IOLs) and advanced testing options are typical elements that may require additional financial considerations. Taking a proactive stance in understanding these nuances is pivotal for financial preparedness.

The Cost Landscape for the Uninsured:

Individuals without insurance coverage face a more intricate decision-making process. Multifaceted factors influence the cost of cataract surgery without insurance. Delving into considerations such as the choice of intraocular lens, the surgical facility’s pricing structure, geographical location, and the surgeon’s fees provides a comprehensive understanding of the financial landscape.

The Role of Geographical Location:

Cataract surgery costs a lot of money, and that number varies significantly from one place to another. Patients should know that healthcare and lifestyle expenditures might differ substantially among regions. It could be prudent for people seeking inexpensive solutions to think about searching elsewhere for options.

Weighing the Surgeon’s Expertise and Fees:

The experience and reputation of the surgeon can impact not only the success of the surgery but also the associated costs. Patients should consider the balance between the surgeon’s fees and the level of expertise to ensure a successful outcome without compromising on quality.

The Crucial Role of Insurance Preauthorization:

Whether covered by insurance or not, obtaining preauthorization is crucial in the cataract surgery journey. Patients should diligently navigate this process, confirming the eligibility of the planned procedure for insurance benefits. Please ensure preauthorization to avoid unexpected financial burdens.

Empowering Informed Decision-Making:

The key to empowered decision-making lies in comprehensive information on the complex landscape of cataract surgery costs and insurance coverage. Patients are encouraged to engage actively with their insurance providers, seeking clarification on coverage details and potential costs associated with specific aspects of the procedure.

Holistic Decision-Making for Eye Health:

Beyond the financial considerations, individuals contemplating cataract surgery should approach the decision holistically, considering both their eye health and overall well-being. A well-informed decision ensures financial preparedness and contributes to a successful and satisfying cataract surgery experience.

Continued Collaboration with Healthcare Providers:

When deciding about cataract surgery, working with healthcare specialists is just the beginning. To provide the best possible postoperative treatment and long-term eye health, patients should keep an open line of contact with their surgeons and other medical staff.

In navigating the multifaceted landscape of cataract surgery coverage, understanding the details, asking the right questions, and proactively seeking information are vital elements that contribute to a seamless and informed decision-making process. By addressing financial considerations and the imperative of optimal eye health, individuals can embark on their cataract surgery journey confidently and clearly.

Invest in your vision, invest in clarity. Explore your cataract surgery options today and secure your future sight. For personalized, hassle-free insurance quotes, visit www.newhealthinsurance.com – your journey to visual freedom starts here.