Table of Contents

ToggleIntroduction

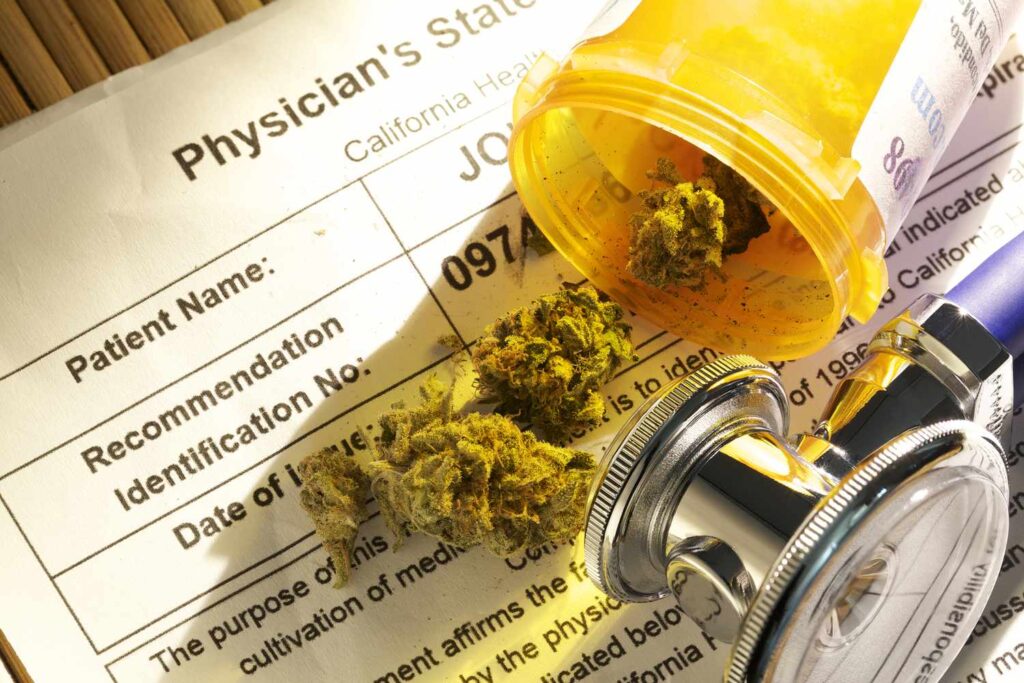

As more and more states have acknowledged the medicinal benefits of marijuana, the landscape of this drug has changed dramatically in recent years. Concerns around the availability and cost of medicinal marijuana have surfaced as more people consider it a possible treatment option. The question of whether insurance covers medicinal marijuana is an urgent one for many people. This detailed guide will explore the subject’s complexities, answering frequently asked questions and illuminating the elements is medical marijuanas covered by insurance.

Understanding the Landscape of Medical Marijuana

The cannabis sativa plant, which is used to make medical marijuana, has just lately had its possible medicinal qualities uncovered. Many people are turning to medical marijuana as a means of alleviating symptoms of various ailments, including chronic pain. On the other hand, medicinal marijuana’s regulatory and policy climate differs substantially across nations and areas.

The Cost of Medical Marijuana

The problem of how much medical marijuana costs must be addressed before we can go into the complexities of insurance coverage. The amount you’ll have to pay for medical marijuana depends on several things, including your home state, the strain you choose, and the facility’s pricing structure. Patients frequently wonder, “How much does medical marijuana cost?” during their first consultation. Many factors affect how much money you can expect to spend on medicinal marijuana; remember that there is no “magic bullet” in pricing.

Insurance Coverage for Medical Marijuana: A Complex Scenario

Numerous variables contribute to the complex and highly varied insurance landscape of medicinal marijuana. Insurance companies still have a hard time covering medicinal marijuana since it is classified as a Schedule I restricted drug on the federal level, even though certain states have legalized it.

Does Insurance cover Medical Marijuana?

The question that many patients wonder is, “Does insurance cover medical marijuana?” There is no easy way to answer this question. At this time, the majority of health insurance policies do not cover medicinal marijuana because of its federal classification as a Schedule I restricted substance. The classification of this substance by the federal government indicates that it has no acknowledged therapeutic benefit and a high potential for misuse.

However, there are exceptions. Some states have taken steps to mandate insurance coverage for medical marijuana, requiring insurance companies to include it as part of their covered services. For example, in New York, there has been ongoing debate and legislative action to address the issue of insurance coverage for medical marijuana. Individuals need to check their state’s specific regulations and policies to understand the extent of coverage available.

Does Medicaid cover Medical Marijuana?

Medicaid, a program run by the federal government and individual states that offers health coverage to low-income persons, is another factor to consider. Medicaid coverage of medicinal marijuana is conditional on rules made at the federal and state levels. Due in large part to its Schedule I status, federal Medicaid does not currently cover medicinal marijuana.

Nonetheless, a handful of states have gone above and beyond to investigate the possibility of Medicaid paying for medicinal marijuana. There may be continuing talks and initiatives to expand Medicaid coverage to include restorative marijuana treatments in places where it is permitted for medical purposes. The best place for people to get the latest details about their coverage is their state’s Medicaid program.

Does Cigna Insurance Cover Medical Marijuana?

Many are wondering whether medical marijuana is covered by Cigna health insurance. Among the many American health insurance providers, Cigna stands out. Most health insurance companies, including Cigna, do not cover medical marijuana due to the federal government’s classification of the drug.

Cigna policyholders should check their plan details and call the insurance company right away to find out what kinds of coverage they have. As long as the FDA gives the go-ahead, Cigna may pay for some cannabis-based medicines. For example, Epidiolex is used to treat certain types of seizures.

Navigating Alternative Options: FSA and HSA

While traditional health insurance may not cover medical marijuana, individuals exploring alternative treatment options can consider utilizing Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA). Individuals can use these accounts to save pre-tax cash for approved medical expenses, which might include some costs associated with medicinal marijuana if the state’s rules are liberal enough.

To avoid confusion, keep in mind that the rules for getting your FSA or HSA to pay for medical marijuana vary and can change. People should look over the IRS rules and regulations and talk to a tax expert to make sure they follow all the rules and regulations.

Frequently Asked Questions (FAQs)

How much does medical marijuana cost?

The cost of medical marijuana can vary significantly based on factors such as the state, the type of product, and the pricing structure of the dispensary. Patients should consult with local dispensaries to get accurate pricing information.

In New York, can insurance companies pay for medical marijuana?

The scenario regarding insurance coverage of medical marijuana in New York is constantly changing and adapting. Staying informed on the current developments in your state is crucial, even though there have been ongoing talks and legislative attempts.

Does Medicaid cover medical marijuana?

The current federal Medicaid program does not cover medicinal marijuana because of its Schedule I status. Patients should contact their state’s Medicaid program for up-to-date coverage information, as restrictions may vary by state.

Does Cigna insurance cover medical marijuana?

Generally, Cigna, like other health insurance providers, does not cover medical marijuana. Policyholders should review their specific plan details and consult directly with Cigna to understand the extent of coverage.

Conclusion

The subject of medical marijuana insurance is complex and constantly evolving. Several states have established laws to address the issue of health insurance companies being hesitant to cover medical marijuana because the federal government classified the medication as a Schedule I restricted substance. Get up-to-date information about medical marijuana treatment options by researching your state’s rules and regulations, exploring other funding sources, and contacting your insurance provider. It is critical to advocate for laws that make medical marijuana accessible and inexpensive for those who require alternative therapies, as the industry is constantly evolving.

Navigating Legal Complexities:

The federal classification of marijuana as a Schedule I controlled substance creates legal challenges for widespread insurance coverage. Understanding the legal landscape is crucial for individuals seeking clarity on the availability of insurance coverage for medical marijuana.

State Initiatives:

Despite federal hurdles, certain states have taken individual initiatives to address insurance coverage for medical marijuana. Staying abreast of state-specific regulations and legislative changes is essential for patients advocating for comprehensive coverage.

Patient Empowerment:

In the face of evolving policies, patients and individuals exploring medical marijuana treatments play a pivotal role. Empowering oneself with knowledge about state laws, insurance policies, and alternative financial options is crucial in making informed decisions.

Consulting Insurance Providers:

Engaging in direct communication with insurance providers is paramount. Patients should proactively seek information about coverage, potential changes in policies, and any emerging options that may facilitate the inclusion of medical marijuana in insurance plans.

Exploring Alternative Financing:

While traditional insurance coverage remains a challenge, exploring alternative financing options such as Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) can provide a financial avenue for those seeking medical marijuana treatments.

Advocacy for Access and Affordability:

As the medical marijuana landscape evolves, advocacy becomes crucial. Individuals, patient advocacy groups, and healthcare professionals should actively engage in discussions and initiatives that promote policies supporting the accessibility and affordability of alternative medical treatments.

In conclusion, no single path exists to comprehending medicinal marijuana insurance coverage. Essential aspects of this changing environment include:

- Understanding the law.

- Keeping up with state initiatives.

- Giving patients more agency.

- Communicating directly with insurance companies.

- Looking into other funding options.

- Advocating for change.

The future of medical marijuana is uncertain, but with the help of individuals and the healthcare system, we can work toward making it more inexpensive and accessible for people who need it.

Ready to explore your health insurance options? Embrace a healthier future today – visit www.newhealthinsurance.com for free quotes and embark on a journey towards comprehensive coverage tailored to your needs.