Table of Contents

ToggleIntroduction:

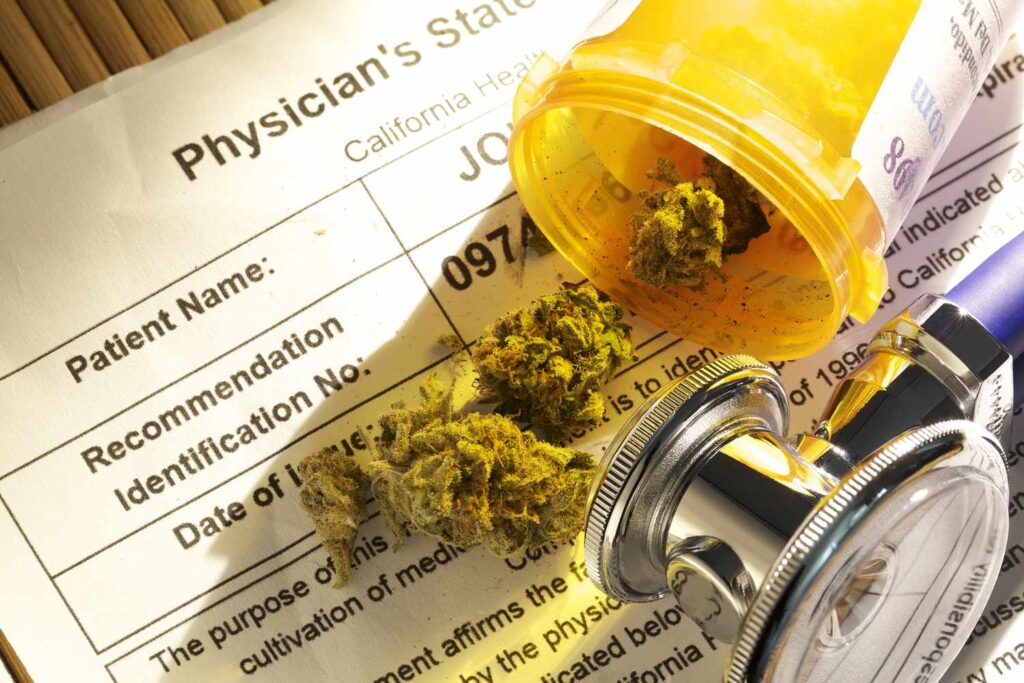

Medical marijuana has become a topic of significant interest and discussion in recent years, as more states in the USA have legalized its use for various medical conditions. With the growing acceptance of medical marijuana, questions about its accessibility and affordability have also come to the forefront. One common query is does health insurance cover medical marijuanas and the associated costs. In this comprehensive guide, we’ll delve into the details, answering FAQs and exploring the state-specific nuances of coverage.

Understanding Medical Marijuana and its Benefits

Before diving into the intricacies of health insurance coverage, it’s essential to understand what medical marijuana is and why it’s prescribed. Medical marijuana is when the weed plant is used. For medicinal purposes, often alleviating symptoms or treating specific health conditions.

Medical marijuana has demonstrated its effectiveness in managing chronic pain, seizures, multiple sclerosis, other health problems, and even cancer-related symptoms. Its potential benefits have led to a surge in demand, raising questions about its affordability and accessibility.

How Much Does Medical Marijuana Cost?

The cost of medical marijuana varies depending on several factors, including the state in which you reside, the specific strain or product prescribed, and the mode of consumption. Below are some common cost considerations:

-

State Variation:

The cost of medical marijuana can significantly differ from one state to another. For example, the cost of medical marijuana in California might not be the same as in New York. This discrepancy is due to state laws, taxation, and regulations variations. Some states with well-established medical marijuana programs may offer more affordable options.

-

Strain and Form:

Different strains of cannabis and various forms of medical marijuana, such as edibles, tinctures, or vaporizers, can have varying costs. Generally, more specialized or rare strains tend to be more expensive than common ones.

-

Dispensary Prices:

Dispensaries are the primary source of medical marijuana. Prices may vary from one dispensary to another, even within the same state. You can get the best deal if you look around and compare prices.

-

Insurance Coverage:

We’ll delve deeper into this topic, but some health insurance plans do offer coverage for medical marijuana, which can significantly reduce out-of-pocket expenses.

-

Affordability Programs:

In some states, affordability programs may be available to help reduce the cost of medical marijuana for patients with financial constraints. These programs aim to make medical marijuana more accessible and affordable to those who need it most.

Does Health Insurance Cover Medical Marijuana?

The million-dollar question: does health insurance cover medical marijuana? The answer is not straightforward. Federal laws primarily govern health insurance policies in the United States, and marijuana is still being called a Schedule I substance that is illegal under federal law, making it illegal for all purposes. However, some states have legalized medical marijuana and enacted laws to address insurance coverage in specific situations.

Let’s break it down:

-

State Laws:

The critical factor determining whether health insurance covers medical marijuana is your state’s laws. Some states, such as California, Colorado, and Oregon, have explicit provisions that protect the rights of medical marijuana patients and require insurance companies to provide coverage for it when recommended by a healthcare professional. These states have taken significant steps in recognizing the medicinal benefits of marijuana.

-

Federal vs. State:

Conflicts between federal and state laws can create challenges. Federal laws may prevent insurance companies from covering medical marijuana, even in states where it’s legal. However, some insurance providers may comply with state laws and offer coverage.

-

Specific Conditions:

In states where medical marijuana is legal, coverage is usually limited to specific medical conditions. Common conditions include chronic pain, cancer, epilepsy, and certain debilitating diseases. To be eligible for coverage, you must have a qualifying medical issue and a recommendation from a doctor.

-

Pre-authorization:

If you have health insurance that covers medical marijuana, you may need pre-authorization from your insurance company. This process involves proving that the treatment is medically necessary and that you meet the eligibility criteria.

Health Insurance and Medical Marijuana Coverage by State

As mentioned earlier, the availability of health insurance coverage for medical marijuana varies significantly from state to state. To give you a clearer picture, let’s look at two states with distinct approaches: Texas and Florida.

-

A. Texas

In Texas, medical marijuana is legal in a limited form. The Compassionate Use Act allows low-THC (tetrahydrocannabinol) cannabis for patients with intractable epilepsy. However, this law does not require health insurance companies to cover medical marijuana.

If you’re a Texan seeking medical marijuana, you will likely be paying out of pocket, as health insurance plans in the state generally do not cover it. This situation can be financially challenging for patients, as the cost of medical marijuana can add up over time.

-

B. Florida

Florida, on the other hand, has a more progressive approach to medical marijuana. The state has a robust medical marijuana program that covers a broader range of medical conditions, including cancer, glaucoma, HIV/AIDS, Crohn’s disease, and more. In Florida, health insurance plans may provide coverage for medical marijuana when recommended by a qualified physician.

In Florida, the cost of medical marijuana may be partially covered by health insurance, making it more accessible and affordable for patients with qualifying conditions.

Is Medical Marijuana Covered by Medicaid?

Medicaid is a government- and state-funded program that helps low-income people and families pay for health care. Whether Medicaid covers medical marijuana depends on several factors, including your state’s Medicaid program, your medical condition, and the federal and state laws governing Medicaid.

While Medicaid is a valuable resource for many low-income individuals, it does not uniformly cover medical marijuana across all states. Here’s what you need to know:

-

State Variation:

Medicaid is administered at the state level, and each state has its own set of rules and regulations. Some conditions may include medical marijuana in their Medicaid coverage, while others may not.

-

Eligibility Criteria:

Even in states where Medicaid covers medical marijuana, there are usually specific eligibility criteria. You may need a qualifying medical condition, and a physician must recommend medical marijuana as part of your treatment plan.

-

Federal Laws:

As previously mentioned, marijuana remains a Schedule I controlled substance under federal law. This complicates matters for Medicaid, as it receives federal funding. States must navigate the legal landscape carefully to determine if and how they can include medical marijuana in their Medicaid programs.

-

Changing Regulations:

As laws surrounding medical marijuana evolve, Medicaid coverage may also vary. Knowing about any new changes to your state’s Medicaid plan is very important.

FAQs:

1. Can I use my regular health insurance for medical marijuana?

In states where medical marijuana is legal and If you have health insurance, you can use your regular health insurance plan to help cover the costs, provided you meet the eligibility criteria.

2. Are there any specific health insurance companies that cover medical marijuana?

Health insurance plans handle medical marijuana differently, depending on the state and the policy. Talking to your insurance company is the best way to determine what they cover.

3. How can I determine if my health insurance covers medical marijuana?

To determine if your health insurance covers medical marijuana, contact your insurance company directly. They can provide information on their policies and whether you qualify for coverage.

4. Should I have a medical marijuana card for my insurance to cover it?

For medical marijuana to be covered by your insurance, you will usually need a medical marijuana card or a note from a qualified doctor.

5. Can I get reimbursed for medical marijuana expenses if my insurance doesn’t cover it?

No matter what kind of health insurance you have, marijuana, you will unlikely be reimbursed for the expenses. However, some states have affordable programs to help reduce costs for needy patients.

6. What conditions typically qualify for medical marijuana coverage?

The qualifying conditions for medical marijuana coverage vary by state but often include chronic pain, cancer, epilepsy, multiple sclerosis, HIV/AIDS, and other debilitating or severe medical conditions.

7. Does Medicaid cover medical marijuana in all states?

Medicaid coverage for medical marijuana is not consistent across all states. It depends on the individual state’s Medicaid program and the specific regulations.

Conclusion:

Whether health insurance covers medical marijuana is complex and largely dependent on state laws and individual insurance policies. While some states have taken significant steps to provide coverage for medical marijuana, others lag.

Suppose you’re considering medical marijuana as part of your treatment plan. In that case, it’s crucial to research your state’s laws, contact your insurance provider, and consult a trained medical worker who can help you through the process. Additionally, stay informed about changing regulations as the landscape of medical marijuana coverage continues to evolve.

In the ever-changing world of medical marijuana, understanding the legal, financial, and medical aspects is essential for those seeking relief through this alternative treatment.

In conclusion, for personalized quotes on health insurance that may cover medical marijuana, visit www.newhealthinsurance.com today and secure your peace of mind.